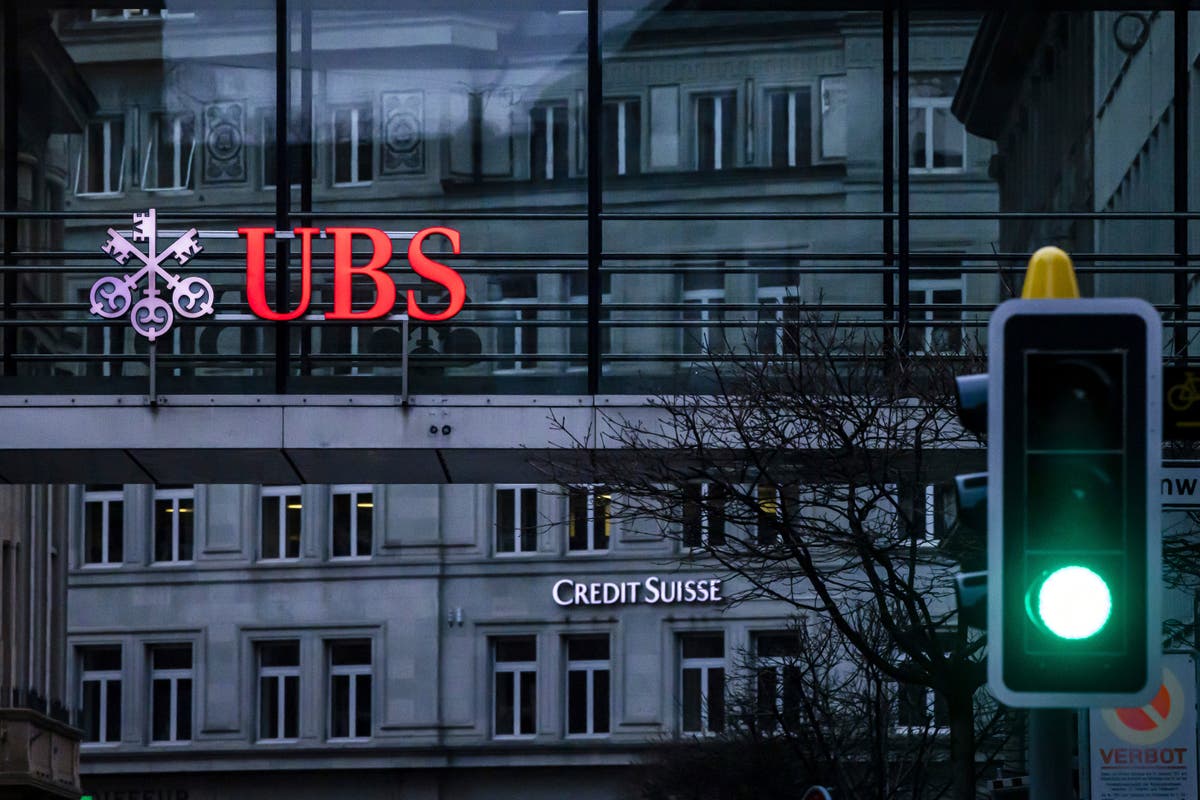

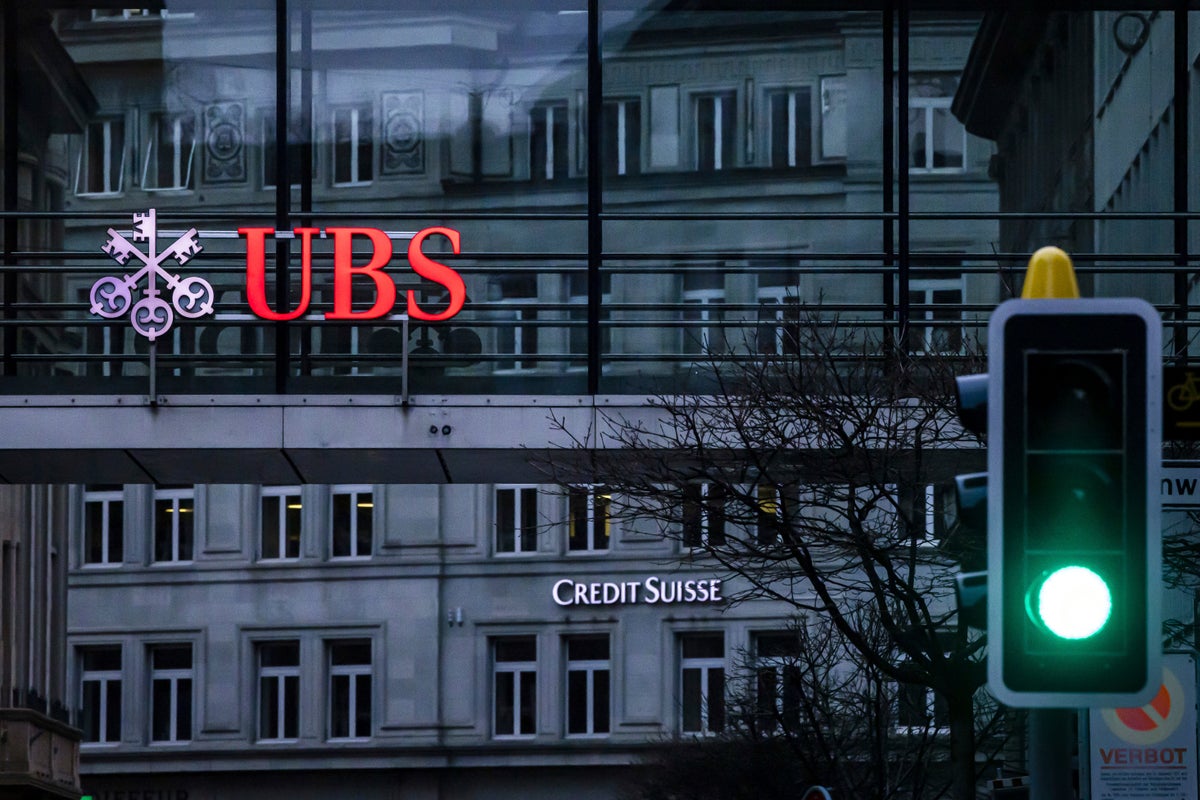

UBS to acquire rival bank Credit Suisse amid crisis

UBS shares have fallen by as much as 16 per cent in early trade, their biggest one-day fall since 2008.

It follows concerns among investors about the long-term benefits of the rescue deal for Credit Suisse and the outlook for banks in Switzerland.

In a package engineered by Swiss regulators on Sunday, UBS Group AG will pay 3 billion Swiss francs (£2.65bn) for Credit Suisse Group AG and assume up to 5 billion francs (£4.4bn) in losses.

Credit Suisse shares slumped 62 per cent, reflecting the huge loss its shareholders will see in their investment in the bank.

Meanwhile, the FTSE 100 was down 0.7 per cent as markets opened in London, after UBS agreed a rescue deal to buy its banking rival Credit Suisse in a $3.2bn takeover.

Asia markets were also mostly down on Monday morning, with Hong Kong’s Hang Seng index leading losses in the region – falling more than 2 per cent and dragged down by healthcare stocks, CNBC reported.

Rishi Sunak speaks to Swiss president about Credit Suisse

Rishi Sunak has spoken to the Swiss president about the Credit Suisse developments, according to the prime minister’s spokesperson.

(PA)

Maryam Zakir-Hussain20 March 2023 12:16

Did SVB break the Fed? Part Two

Economists and investors so far expect the Fed to proceed with another quarter point interest rate increase at its March 21-22 meeting, but only because inflation poses such a persistent risk policymakers won’t want to divert from efforts to control it.

The financial system, meanwhile, has been thrown extra support under a new Fed lending program for banks, while its traditional lender-of-last-resort cash window was tapped for a record $150 billion.

Fed officials gather this week having agreed bank stress poses a “systemic risk” to the economy, and “in any other hiking cycle this…would end the tightening process and perhaps send it into reverse,” said Ed Al-Hussainy, senior rates analyst at Columbia Threadneedle Investments. “The difference today is the Fed’s focus on inflation.”

In a recent Reuters poll 76 of 82 economists said they expect the Fed to approve a quarter point rate increase at this week’s meeting, lifting the target federal funds rate to a range between 4.75% and 5%. A similarly strong majority expect a further increase at a future Fed session.

The Fed’s policy statement will be released Wednesday at 2 p.m. (1800 GMT) along with closely watched projections from officials for the policy rate at year’s end, perhaps the best clue to how recent financial stress has reshaped the Fed’s outlook.

As of December officials expected the policy rate would rise to around 5.1% by year’s end.

(PA Wire)

Maryam Zakir-Hussain20 March 2023 11:38

Did SVB break the Fed? Officials mull risks of more rate increases

At an early January meeting of the Virginia Bankers Association, executives were already nervous that Federal Reserve interest rate increases were making it hard to compete for deposits.

“Everywhere I go in the industry people are feeling that kind of pressure,” the featured speaker of the day, Richmond Fed President Thomas Barkin, said in response to a question from the audience. The influence of Fed rate hikes “is going to hit…That is how it is designed.”

When Fed officials meet this week the suddenly urgent question is whether the level of pressure on the banking industry has become so great it risks a larger financial crisis – the sort of event associated with deep and hard-to-arrest economic downturns – and warrants a slowdown or pause to further rate increases.

The Fed and global central banks, after a tense 10 days with banks teetering in the U.S. and Europe, launched a second round of weekend efforts to buttress the system by expanding the Fed’s ability to ship dollars where needed. Separately a deal was struck for UBS to acquire the troubled Credit Suisse in a takeover reminiscent of the global financial crisis 15 years ago.

After the announcement Treasury Secretary Janet Yellen and Fed Chair Jerome Powell issued their second Sunday afternoon statement of reassurance in as many weeks, saying as Asian markets prepared to open for the week that “the capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient.”

The issue for Powell and his colleagues is whether the calming words and a bank lending new program are enough to stem broader problems and allow them to proceed with what has been their priority to now: Combating inflation with the ever-higher interest rates now bedeviling the banking system.

Maryam Zakir-Hussain20 March 2023 11:05

‘Banking panic’ has ‘gone global’, says analyst

The “banking panic” is “not going away” and has instead “gone global”, an analyst has warned, as banking shares took a hit this morning, following the days of unease sparked by the collapse of Silicon Valley Bank and Credit Suisse rescue deal.

“It should be clear that after more than a week into the banking panic, and two interventions organised by the authorities, this problem is not going away. Quite the contrary, it has gone global,” said Mike O’Rourke, chief market strategist, Jones Trading.

Andy Gregory20 March 2023 10:27

UBS shares suffer largest fall since 2008 after Credit Suisse deal

UBS shares fell by as much as 16 per cent in early trade, their biggest one-day fall since 2008, amid concerns among investors about the long-term benefits of the rescue deal for Credit Suisse and the outlook for banks in Switzerland.

In a package engineered by Swiss regulators on Sunday, UBS Group AG will pay 3 billion Swiss francs (£2.65bn) for Credit Suisse Group AG and assume up to 5 billion francs (£4.4bn) in losses.

Credit Suisse shares slumped 62 per cent, reflecting the huge loss its shareholders will see in their investment in the bank.

Andy Gregory20 March 2023 10:02

European banks take early hit after Credit Suisse rescue deal agreed

There is some volatility in European bank shares this morning, following the rescue deal for Credit Suisse.

Some banks in the UK and Europe saw significant drops in value as they opened, with most having since recovered the losses of a further fall but still languishing below Friday’s closing prices.

Germany’s Deutsche Bank and France’s BNP Paribasare were both impacted this morning, while in the UK, Standard Chartered, HSBC and Barclays were among those affected, the BBC reported.

Andy Gregory20 March 2023 09:21

Markets weakness ‘reinforces concerns’ of spillover, says analyst

Weakness in markets this morning “serves to reinforce concerns” of any “spillover effects on the rest of the banking sector”, an analyst has suggested.

“With Credit Suisse shareholders and some bondholders taking a huge hit, banks in Asia have taken a hit on similar concerns about [some of their] bond-holding values,” said Michael Hewson, chief market analyst at CMC Markets.

“While the weekend deal still presents the Swiss National Bank and Swiss Government with untold headaches, with the size of the newly merged bank set to dwarf the size of the Swiss economy.

“The phrase too big to fail really does spring to mind here, and this morning’s weakness in Asia markets serves to reinforce concerns about these types of writedowns and any spillover effects on the rest of the banking sector.”

Andy Gregory20 March 2023 08:54

FTSE 100 falls after Credit Suisse sold to UBS

The FTSE 100 has fallen after struggling bank Credit Suisse was sold to Swiss rival UBS.

London’s top index opened trading on Monday sharply lower down 0.7 per cent, led by banks as expected. Meanwhile, the pound remains among the biggest winners against the dollar and trades just below $1.22.

Markets in Asia were struggling earlier in the morning, with shares in Hong Kong falling by more than 3 per cent as the banking sector took a battering.

My colleague Thomas Kingsley has more details:

Andy Gregory20 March 2023 08:23

Swiss union ‘shocked’ after UBS takes over ailing Credit Suisse

The Swiss Bank Employees Association has demanded that UBS keep job cuts to an “absolute minimum” amid reports of a merger with Credit Suisse, reported Reuters.

The employees’ body said it was “deeply shocked” after UBS’ government-backed offer to acquire its ailing rival.

“The jobs of very many employees are at stake,” it said, adding that it was in touch with management.

The statement underscores the sense of unease in Switzerland, with its reputation as a global financial centre on the line.

(‘ KEYSTONE / MICHAEL BUHOLZER)

Sravasti Dasgupta20 March 2023 07:30

Will the Bank of England hold its rates as US Federal Reserve faces a nasty dilemma?

Which matters more: control of inflation or financial stability? The world’s central bankers now find themselves facing that vexing question, particularly those in the US where there are very real concerns about smaller banks after the collapse of Silicon Valley Bank (SVB) and a “flight to quality” among depositors.

Sravasti Dasgupta20 March 2023 07:00

More Stories

Etsy accused of ‘destroying’ sellers by withholding money

Key consumer protection powers come into force

BAT not about to quit London stock market, insists new chief